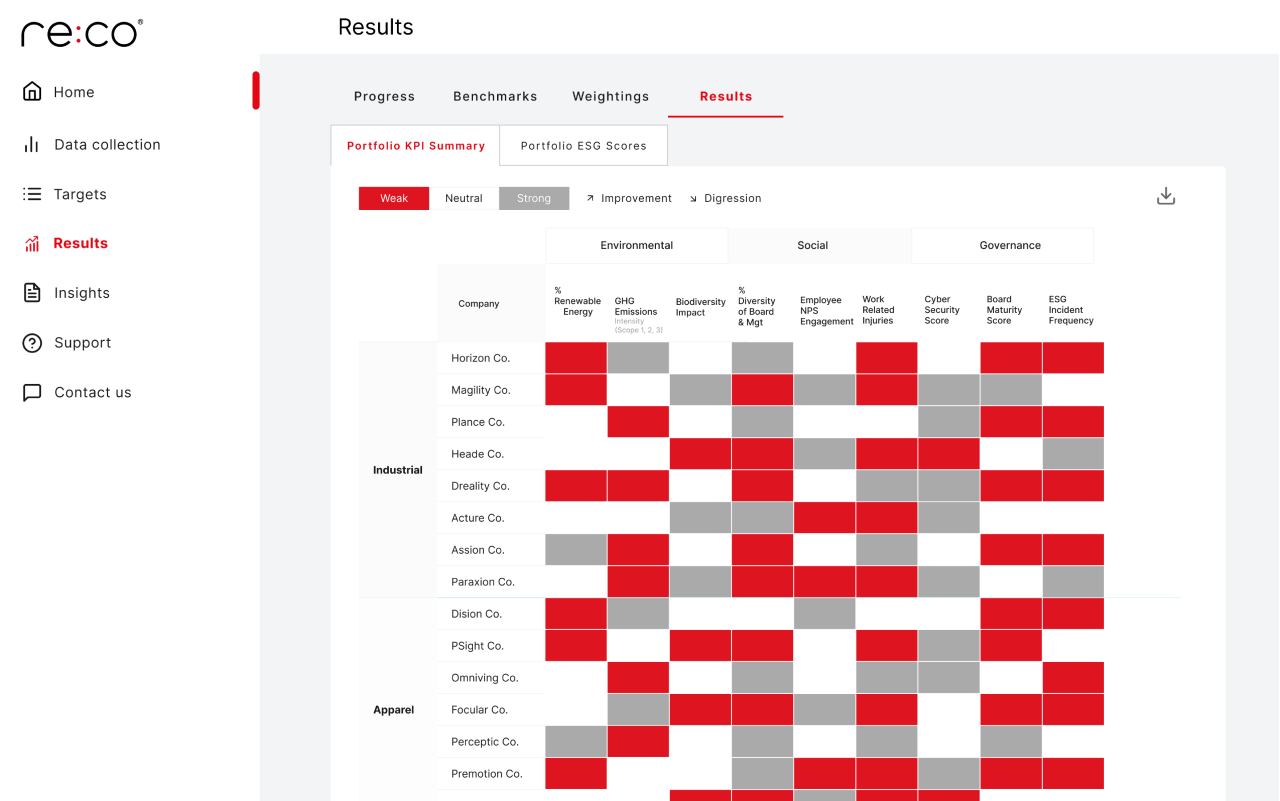

Our solutions enable private market players to unlock value through sustainability performance

Data

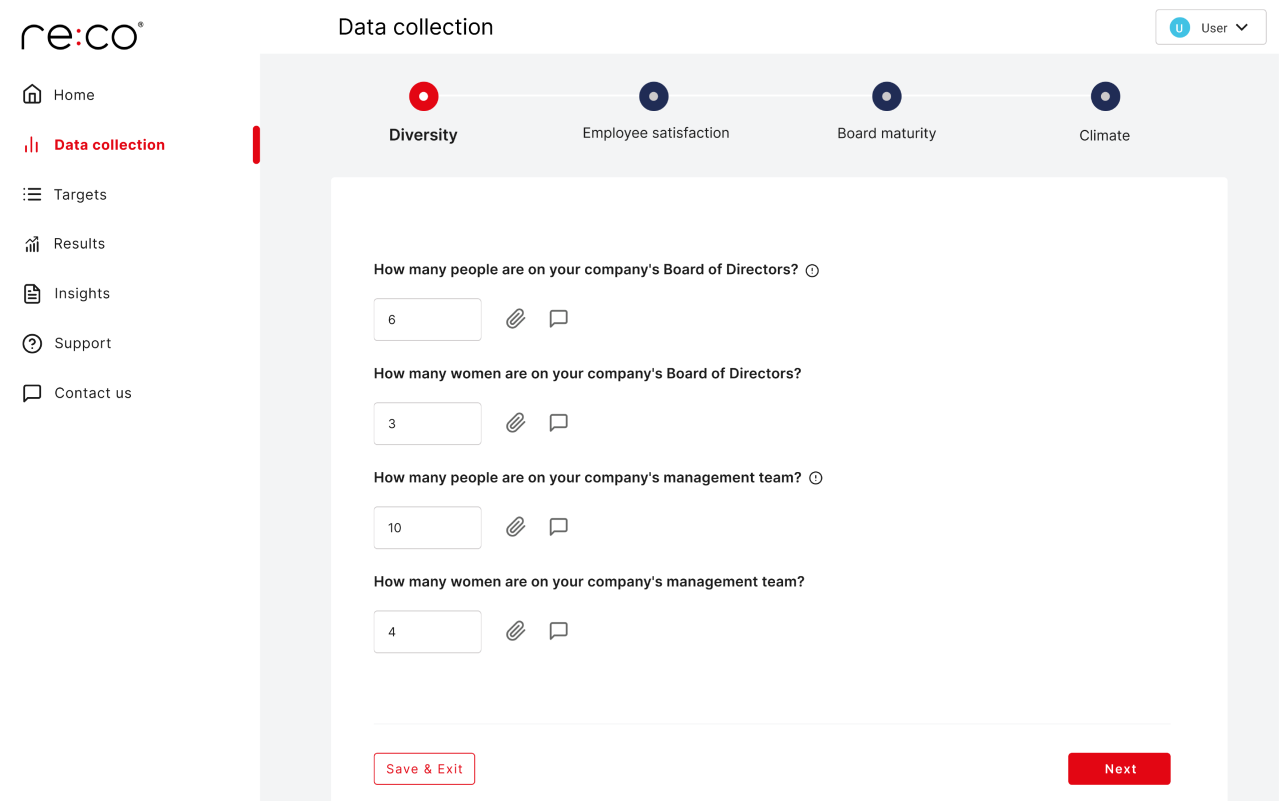

Simplify sustainability data collection and turn insight into action:

- Sustainability Data Collection

Streamline data gathering and quality checks - GHG & Renewable Energy Calculations

Simplify calculations for your global portfolio with an easy-to-use interface and global datasets - CSRD Strategy & Compliance

Accelerate compliance with end-to-end support from Double Materiality Assessment to data collection - Sustainability Reporting

Generate investor-ready disclosures with high-quality data

Strategy

Integrate sustainability into your competitive advantage:

- Action Planning

Turn data into actionable next steps to improve performance - Sustainability Strategy

Identify opportunities to differentiate through sustainability leadership - Decarbonisation Strategy

Set targets, implement reduction plans, and unlock value - Fund-Level Advisory

Identify risks, opportunities and value drivers across your portfolio

Value

Capture the financial benefits of sustainability leadership:

- Sustainability Value Creation Plans

Turn sustainability into a lever for growth and optimisation - Value Monitoring & Progress Tracking

Review progress against targets and empower your team to make improvements - Sustainability-Driven Exit Strategy

Vendor due diligence and value positioning for exits - Value Alongside Compliance

Leverage disclosures, such as CSRD, to drive strategic prioritization and create value

_logo.png)