Our solutions enable private market players to unlock value through sustainability performance

Data

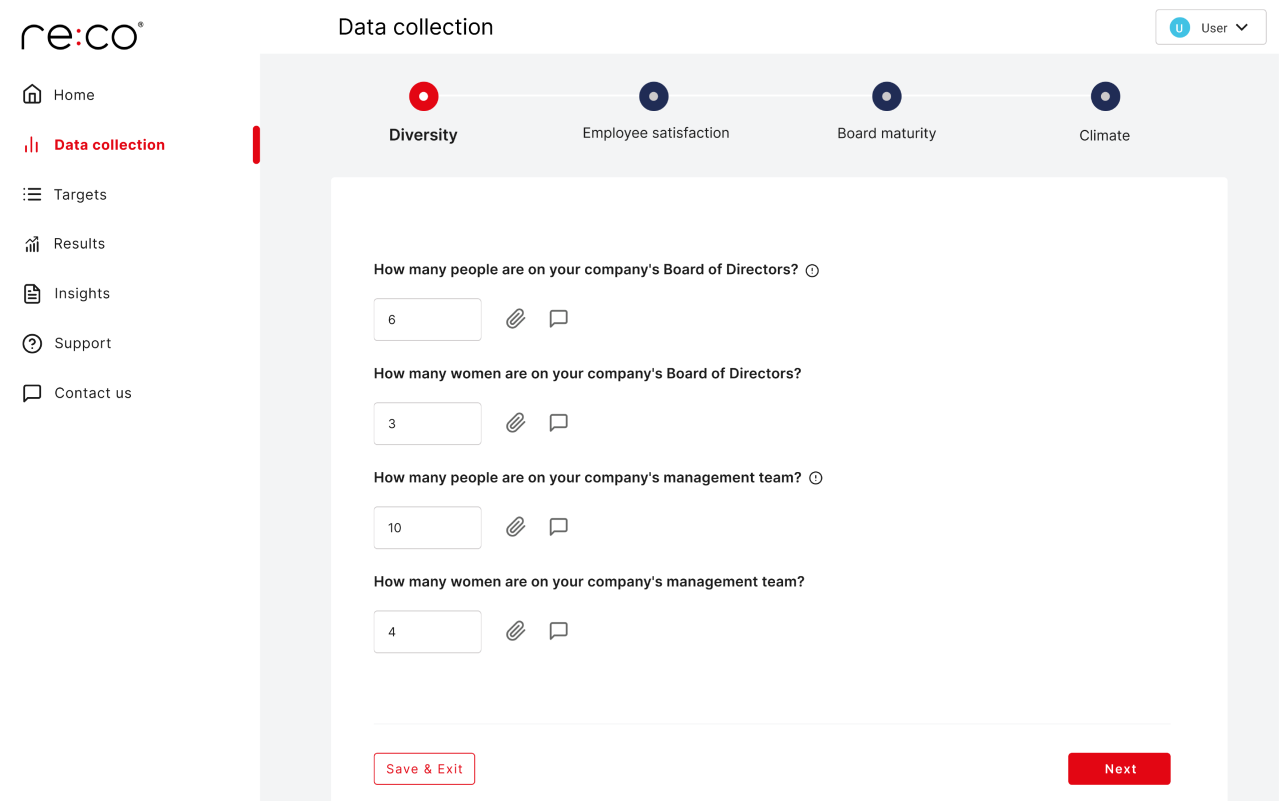

We simplify data collection and turn insight into action:

- Responsible Investment Data Collection

Streamline data gathering and quality checks - GHG & Renewable Energy Calculations

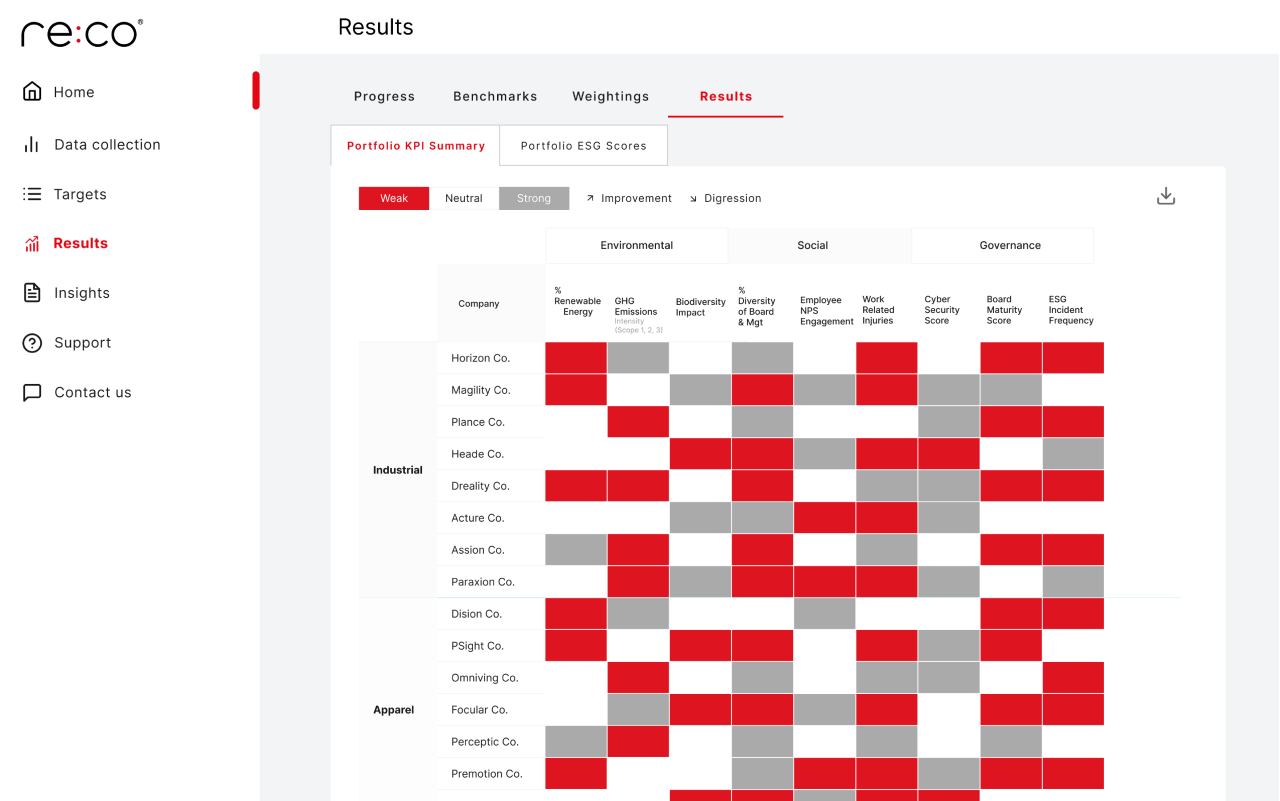

Simplify calculations for your global portfolio with an easy-to-use interface and global datasets - Portfolio-Level Insight Reporting for LPs

Draw insights from your rich data set to exceed investor expectations - Portfolio Company Performance Diagnostics & Insights

Identify company-level performance improvement opportunities

Strategy

We integrate sustainability into your competitive advantage:

- Portfolio Company Action Planning

Turn data into actionable next steps to improve performance - Portfolio Company Sustainability Strategy

Identify opportunities to differentiate through sustainability leadership - Fund-Level Sustainability & Responsible Investment Advisory

Identify risks, opportunities and value drivers across your portfolio - Responsible Investment Training & Capacity Building

Build practical skills for in-house teams on a range of responsible investment topics

Value

We quantify the financial benefits of sustainability initiatives:

- Sustainability Value Scan & Rapid Opportunity Assessment

Quickly identify where sustainability can create or protect value - Value Identification, Quantification, & Strategic Transformation

Clarify value creation opportunities and assess financial potential - Value Tracking & Performance Monitoring

Monitor progress on value creation and develop proof-points - Sustainability-Informed Exit Positioning

Develop compelling evidence-backed narratives showcasing value created during hold

_logo.png)